GCash, the Philippines’ most widely used e-wallet, is trusted by millions and holds over 80% of the local e-wallet market.

Backed by Globe (Ayala Group) and integrated with Ant Financial’s global network, it enables instant, secure, and convenient online payments, including one-time and recurring transactions.

For businesses in the Philippines, supporting GCash is essential to reach the country’s primary base of digital payment consumers.

Payment type Wallet

Payment flow Redirect

Integration type API Reference / Payment Page / Payment Link

Countries Philippines (PH)

Currencies Philippine Peso (PHP), Hong Kong Dollar (HKD), Singapore Dollar (SGD)

Min amount 1.00 PHP

Max amount 100000.00 PHP

Recurring Yes

Refund Yes

Partial refunds Yes

Multiple partial refunds Yes

Chargeback Yes

Principle of operation

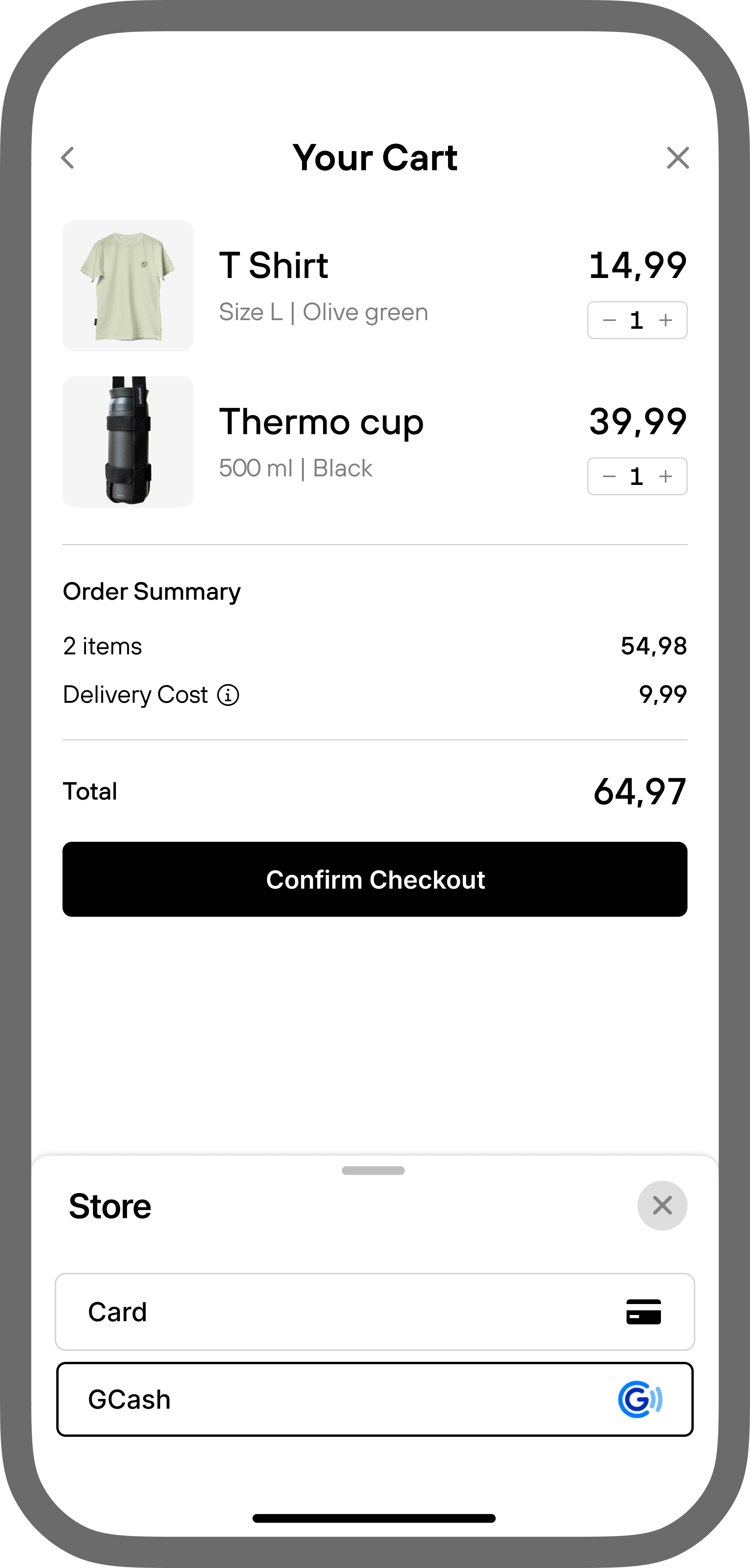

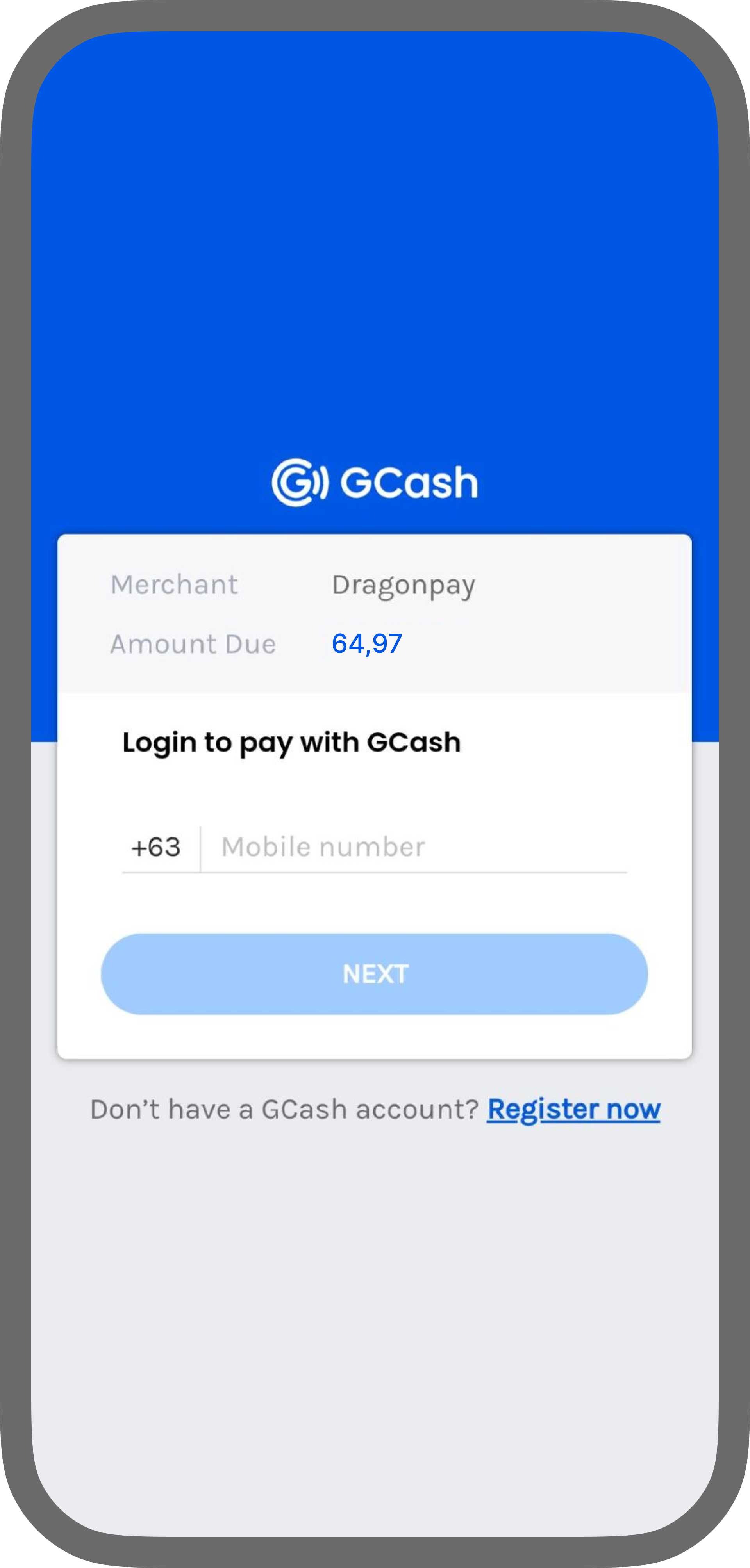

- Selection at checkout

Customer selects GCash as the payment method during checkout. - Payment initiation

System creates a payment request with a recurring mandate set up and redirects the customer to the GCash authorization page. - Authentication and authorization

Customer scans the QR code and authenticates the payment in the GCash application. During this step, the customer consents to link their GCash account to the merchant and accepts the recurring billing terms. - Payment confirmation

GCash automatically charges the customer for the initial payment. - Merchant notification

Merchant receives a webhook confirming the successful transaction.

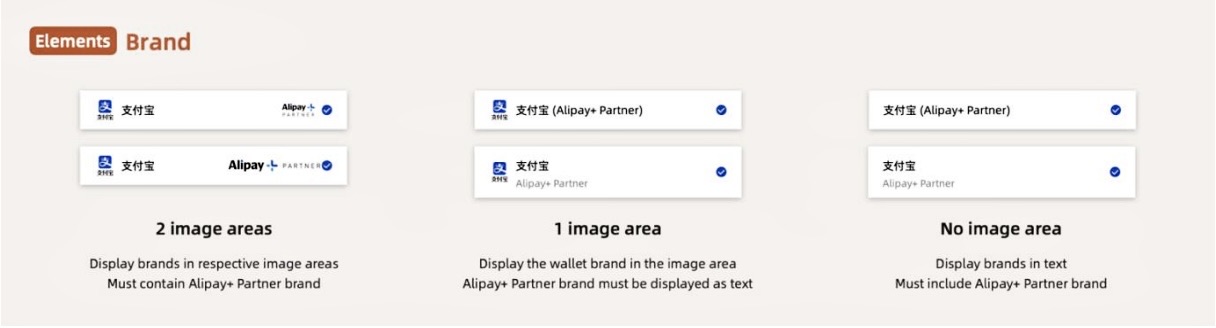

Brand requirements

Merchants must display the Alipay+ Partner brand and the wallet brand based on available image area:

- 2 image areas: Show wallet brand and Alipay+ Partner image.

- 1 image area: Display wallet brand as an image and Alipay+ Partner brand as text.

- No image area: Display both brands as text.

Merchant has to make changes on both desktop and mobile platforms before and after authorization screen as per below.