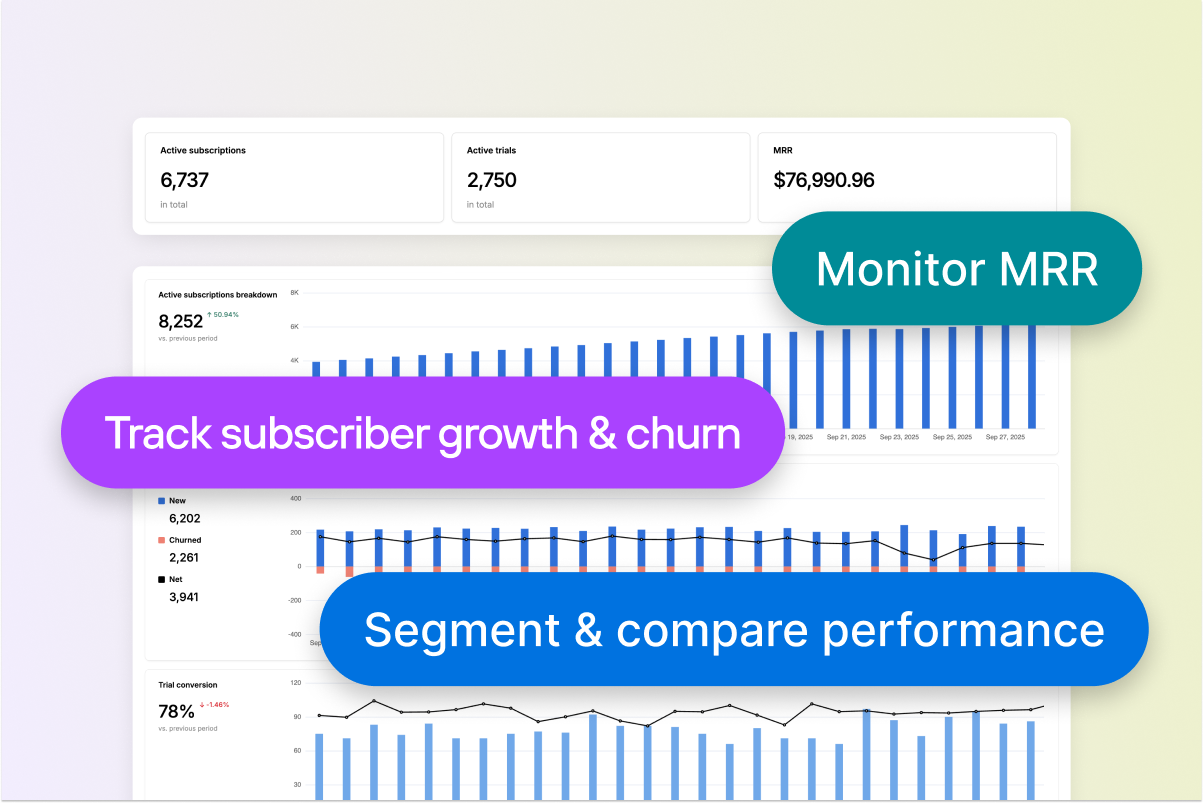

As digital transactions continue to evolve, businesses need efficient solutions to manage payments, pricing, and overall customer billing experience. Solidgate addresses this need and provides a comprehensive billing system tailored to support different business models, helping optimize operations and enhance revenue management.

At the core of this solution are flexible product, pricing, taxes, and

A feature for a payment arrangement where a customer authorizes the automatic and periodic withdrawal of funds from their account to fulfill ongoing financial obligations.

subscription

management features that allow merchants to customize their billing approach.

In Solidgate, products represent the goods or services available for purchase, while pricing options empower businesses to sell in multiple currencies, reaching customers worldwide.

Merchants have complete control over billing operations, encompassing product and price creation, and subscription management via the

Solidgate

Hub

or

Solidgate

API

, ensuring a flexible and scalable payment framework.

With products and pricing in place, merchants are fully equipped to offer one-time products for single purchases and recurring products for subscriptions. Businesses can manage subscription services, update payment credentials, and access product details. Additionally, Solidgate offers a tax solution for accurate tax determination, filing, and compliance. This lets you focus on growing your business instead of handling tax issues.