This standard payment process includes initially

This process involves the merchant obtaining authorization to hold a customer’s funds, Solidgate communicating with the acquirer to process the transaction, and the merchant settling the transaction.

authorizing funds

and settling after verifying the transaction, effectively reducing the risks of payment returns.

It starts with payment initiation, followed by encryption and fraud checks, and concludes with authorization by the issuing bank after thorough verification. Once the payment is successfully authorized, the settle step transfers funds from the customer’s account to the merchant’s account.

Usage terms

Auto-settlement conditions:

- Set

typeauth is required for authorization transactions. - Define

payment_typeof the transaction as CIT/MIT to understand the maximum value. - Specify

settle_intervalvalue.

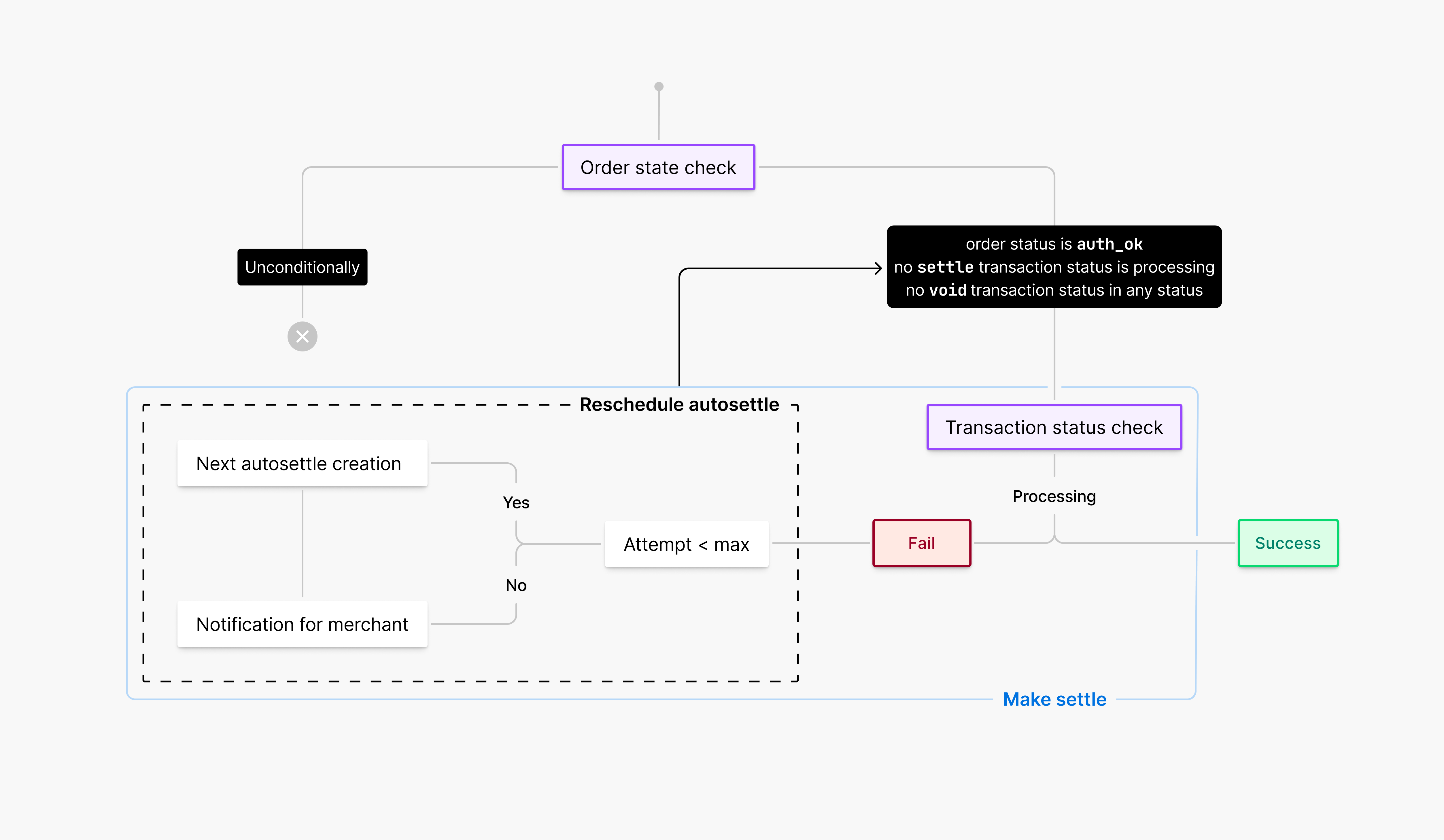

Auto-settlement is performed if:

- order

statusis auth_ok , and there is

When initiating a payment with type

auth

, the transaction begins with a

processing

Efficiently manage card payments and monitor key payment statuses in real-time.

status,

indicating the authorization request is underway and awaiting a final result. If fund authorization is not completed, settlement is paused until authorization is successful, status changes to

auth_ok

. At

auth_ok

, funds are confirmed reserved, and product access can be granted. The system then schedules the settlement operation, finalizing the transaction.

If the first transaction attempt to complete the payment fails, the system retries up to six times within

24

hours, every

4

hours, regardless of the settle_interval. Auto-calculation process starts 3 minutes before the settle_interval and continues for

24

hours if needed. For orders with incomplete fund authorization, the settlement process is not initiated.

Transactions with one or more cancelled operations are not automatically completed, ensuring that only valid and complete transactions are processed.

Settlement terms

Defining the payment_type of the transaction as either customer-initiated (CIT) or merchant-initiated (MIT) is important for determining the maximum settlement interval for VISA payments. In addition, the type of card brand may dictate specific checks that must be applied to ensure that all transactions meet the defined limits and rules the payment network sets.

Solidgate handles the settlement process based on the transaction payment_type and card scheme.

- CIT Visa payments: Maximum 240 hours (10 days).

- MIT Visa payments: Maximum

120

hours (5 days).

If the transaction is MIT and the specifiedsettle_intervalexceeds 120 hours, like for CIT, it is adjusted to 120 hours, in line with Visa’s merchant-initiated payment limits. - Other payment systems: Maximum

144

hours (6 days).

If the card is identified as non-Visa and the specifiedsettle_intervalexceeds 144 hours, it is limited to 144 hours.

Additionally, Solidgate ensures smooth settlement by comparing the settlement limit on the Payment Service Provider (PSP) side with the specified settle_interval set by the merchant for the product.

If the PSP’s maximum settlement period is shorter than the specified settle_interval, the system adjusts the interval to match the PSP’s limit, for:

- Stripe: Maximum 113 hours.

- Bamboo: Maximum 96 hours.

- Ebanx: Maximum 95 hours.

- Razorpay: Maximum 72 hours.

- Braintree: Maximum 72 hours.

- JPMorgan: Maximum 72 hours.

If the PSP does not specify a maximum period or if their maximum is longer than the specified settle_interval, no changes are made to the settlement date.

In all these cases, the system manages settlements based on the set interval, eliminating the need for a separate settle API request.

Recurring payments

The settle_interval parameter defined for a

Customize, update, and manage products and pricing efficiently.

product

applies universally to both initial and subsequent recurring transactions associated with that product. For products with trial periods, the initial payment’s settlement interval is defined separately by the trial settings, whereas subsequent recurring payments follow the primary product’s configuration.

Solidgate recommends transitioning to a

144

hours (6 days) interval for both trial and primary billing periods to improve

Navigate Visa’s fraud and dispute monitoring strategies for enhanced compliance.

VAMP

ratios according to VISA standards. The same recommendation applies to one-time and non-subscription upsell payments.

This extended authorization period helps mitigate

Track fraud metrics and implement prevention strategies to fight fraud.

fraud

and

Manage chargebacks effectively to minimize losses and protect your business.

chargebacks

risks, as disputes cannot be filed against authorized but unsettled transactions.