Successful payment protection combines operational efficiency with strategic prevention. Through essential

Dispute process initiated by a cardholder, resulting in the reversal of a transaction and funds returned.

chargeback

management capabilities and comprehensive

Payment fraud involves unauthorized transactions using stolen payment or identity information, causing financial losses.

fraud

insights, Solidgate helps merchants build effective strategies while maintaining smooth operations and compliance standards.

Prevent

Early detection and proactive prevention minimize financial losses and protect a business reputation. Prevention tools, fraud insights, and alert services help stop disputes before they escalate into chargebacks. Analyze fraud patterns and use prevention alerts to implement targeted strategies that reduce risk and protect revenue.

Key capabilities:

- TC40 (Visa) and SAFE (Mastercard) fraud reporting integration

- Real-time fraud alert webhooks for immediate action

- Fraud rate calculation and threshold monitoring

- Anti-fraud velocity rules and transaction blocklists

Key services:

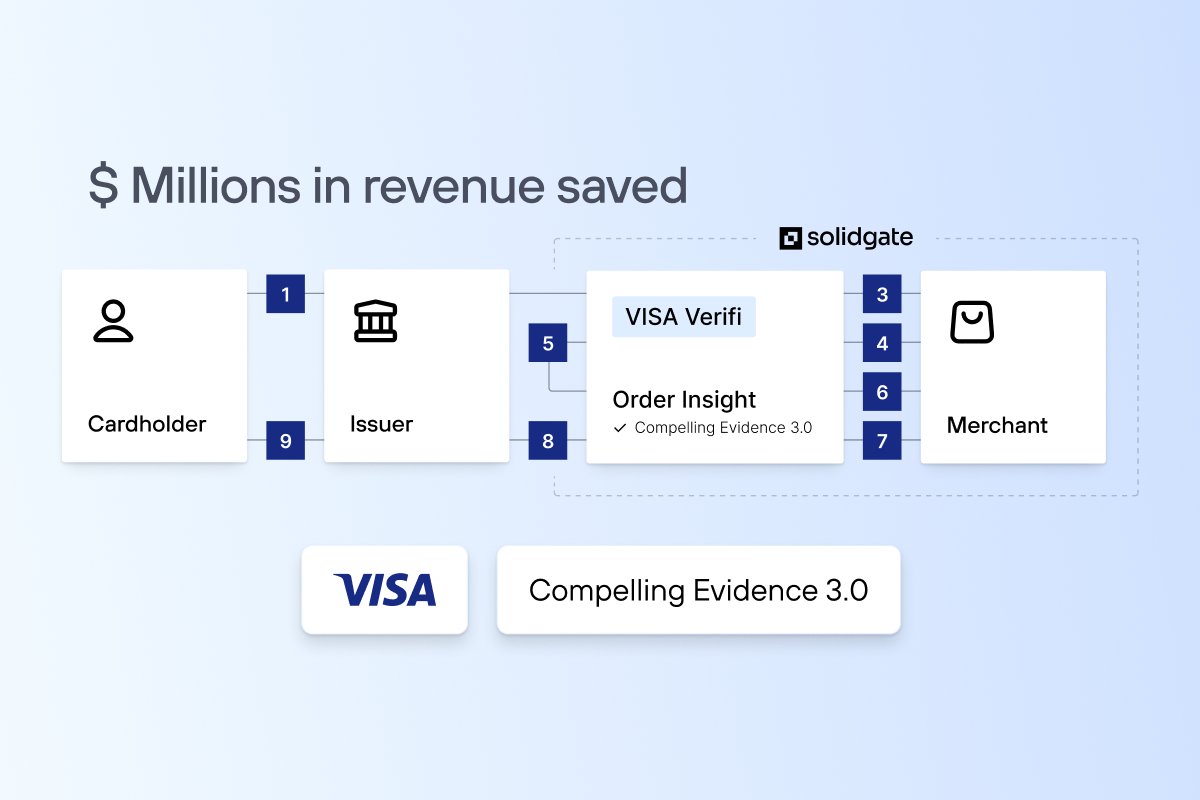

- Prevent: Order Insight, Consumer Clarity, and Compelling Evidence 3.0 to reduce friendly fraud

- Resolve: RDR, CDRN, Ethoca, and Mastercom Collaboration for instant refunds

- PayPal alerts: Real-time notifications for payment issues and disputes

Card networks use specific codes to categorize fraud types. Understand them to:

- Identify patterns in unauthorized transactions

- Spot high-risk transaction patterns

- Implement targeted fraud prevention measures

- Build data-driven risk management strategies

Respond

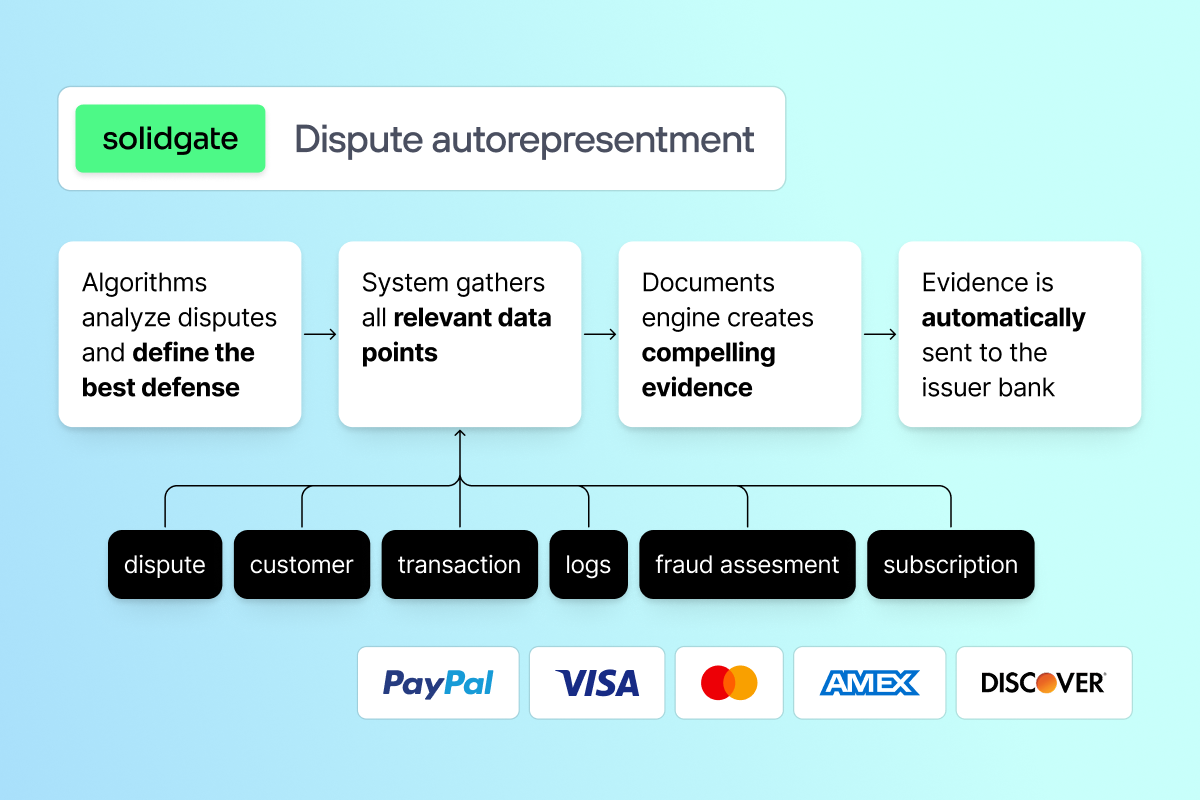

Effective dispute management requires timely responses backed by compelling evidence. Solidgate provides tools to handle disputes through Hub or API, offering structured workflows from initiation to resolution with automated and manual representment options to maximize your success rate in fighting unjustified disputes.

Key capabilities:

- Real-time chargeback webhooks for immediate notification

- Comprehensive dispute reports and analytics via API

- Automated and manual representment workflows

- Evidence collection, enrichment, and submission tools

Main features:

- Understanding internal disputes, claims, and external chargebacks

- Navigating dispute lifecycle stages from inquiry to escalation

- Identifying root causes to apply preventive measures

- Best practices for record-keeping and timely customer communication

Each card network defines specific reason codes and understanding these codes helps you:

- Identify root causes and dispute patterns

- Prepare appropriate evidence tailored to each reason code

- Implement preventive measures to address recurring issues

- Respond within network-defined timeframes

Comply

Card network, or a card scheme, is a financial infrastructure that supports electronic payments by setting and ensuring standards for merchants, acquiring banks, issuers, and processors.

Card networks

actively monitor monthly dispute and fraud activity to protect cardholders and maintain payment system integrity. When disputes exceed acceptable thresholds, merchants are enrolled in monitoring programs that impose monthly penalties, additional fees, and require corrective action plans. Maintaining compliance is essential to avoid financial penalties and preserve card payment processing capabilities.

Maintaining compliant ratios protects businesses from penalties, ensures uninterrupted payment acceptance, and reduces operational costs.